Table of Content

- Retirement Age

- Can I Maintain My Take Home Pay While Maxing Out My 401(k) Contributions?

- There’s still time to make these smart tax moves before the end of the year—your future self will thank you

- Blinged-out Brooklyn bishop who was robbed during sermon hit with federal fraud and extortion charges

- Auto

- SAVINGS AND CD RATES

All examples are hypothetical and are intended for illustrative purposes only. When you first started your job, you probably filled out IRS Form W-4. The form asks you for your filing status and then has you calculate how many exemptions you're eligible to take. Based on this information, your employer then withholds what you say is the proper amount of federal income tax from your paycheck. In general, the more withholding allowances you claim on Form W-4, the less money will be withheld for tax and the greater your take-home pay will be.

This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. Depending on the type of IRA and certain other factors, these earnings, as well as the original contributions, may be taxed at your ordinary income tax rate upon withdrawal. A 10% penalty may be imposed for early withdrawal before age 59½. Your contributions will directly affect your take-home pay if you have the option of a Roth 401 because your contributions are made with after-tax dollars. The biggest advantage of the Roth 401 is that the earnings aren't taxable. This can end up saving you a lot in taxes once you've reached your retirement years.

Retirement Age

You may have several options to maintain your take-home pay that go beyond changing your 401 contributions and W-4 withholdings. You are solely responsible for the accuracy of any data you enter into this calculator and the calculations are based on the information you have entered. For example, say you're in the 15% tax bracket and start contributing $200 per month to your 401. However, your federal tax withholding will likely drop by $30, because you have $200 less in income.

But your pay might not be greatly reduced when you increase the amount you contribute each month. One of the easiest ways to increase the amount you contribute is to add to the amount each time you're given a raise. You might not even notice a difference in your take-home pay in this case. Because the more you contribute by Dec. 31, the more you can shave off your taxable income for the year. Your earnings are based on the market return percentage you provided. Earnings are calculated annually and include each year's total contributions.

Can I Maintain My Take Home Pay While Maxing Out My 401(k) Contributions?

The downside is you’ll likely pay taxes on the amount converted. The return on your investment is the percentage the account value increases based on your investment’s performance. This calculator assumes that your deposits are made at the beginning of the year, and the return is compounded at the end of the year.

This is "free" money that you otherwise would be passing up, and it can greatly affect your future. You may struggle in your retirement years if you don't save adequately now. In addition to the conversion taxes, the move can push you into a higher tax bracket.

There’s still time to make these smart tax moves before the end of the year—your future self will thank you

By increasing your contribution to $300, you'll only pay around $255 per month for federal taxes. You've added $100 to your 401 and you're now paying $15 less in taxes per check. Your increased contribution of $100 has really only affected your take-home pay by $85.

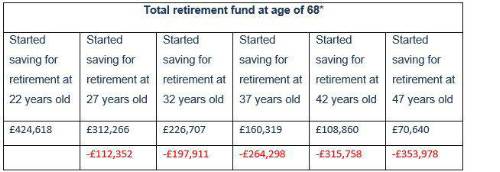

When saving for retirement, you may also want to consider the amount of social security, and other benefits or wages you will receive each month. Living expenses such as mortgages, cars, predictable medical expenses, etc. should also be factored in. Besides the missed opportunity of accumulating compounding interest, the other major advantage of a 401 plan is the tax savings from pre-tax contributions. The charts below show the potential tax savings that you could miss out on by waiting. Information and interactive calculators are made available to you only as self-help tools for your independent use and are not intended to provide investment or tax advice.

Neither these calculators nor the providers and affiliates thereof are providing tax or legal advice. You should refer to a professional adviser or accountant regarding any specific requirements or concerns. Contribution Rate Percentage of your salary you're currently contributing to your plan account. If you contribute a portion of your salary on a dollar deferral basis, you can convert your dollar deferral portion to a percentage for purposes of this calculator.

In addition, such information should not be relied upon as the only source of information. This information is supplied from sources we believe to be reliable but we cannot guarantee its accuracy. Hypothetical illustrations may provide historical or current performance information. Past performance does not guarantee nor indicate future results. 401 Contribution, as discussed, is a type of calculator wherein an individual can calculate the amount he can invest in a 401 plan and what amount his employer will contribute.

Of course, taxes will be due when you withdraw money from your Plan. For example, if you made $30,000 last year, and put $3,000 in your retirement plan account on a pre-tax basis, your taxable income for the year would have been $27,000. (Note that other pre-tax benefits could lower your taxable income further.) After-tax contributions are those you make from your net pay, that is, your income after taxes.

A good starting point is 5% if you're not receiving an employer match. The hope is that you’ve had enough tax withheld throughout the year to avoid a surprise bill. However, a few things — like freelance work or abonus— could inflate your total earnings. Your state tax rate is calculated based on your input for Annual Salary and State Residence. Goals are very subjective and highly dependent on individual circumstances.

GuidedSavings by GuidedChoice® offers a "hands-free" service to keep your account on track. Since the market continually changes, your account is rebalanced on a quarterly basis to balance your fund allocations. The earlier you start contributing to a retirement plan, the more the power of compound interest may help you save. Use our retirement calculator to see how much you might save by the time you retire based on conservative, historic investment performance. When you make your 401 contribution, you do so on a pre-tax basis, meaning the amount comes out of your gross pay. For example, if you make $2,000 a month in gross pay and currently contribute $200 a month to your 401, you’re only taxed on $1,800.

No comments:

Post a Comment